ESG – What really matters is net zero!

The problem

Recent publications around the world indicate that low asset quality as well as heterogenous standards make carbon offsetting a real litigation and environmental risk. The New York Times quotes “Has the Amazon reached its Tipping Point?” (January 4th, 2023), the Zürich based Tagesanzeiger states “Klimakompensierer unter Druck” (February 21, 2023), and Bloomberg quotes “Faulty Credits Tarnish Billion-Dollar Carbon Offset Seller (March 24, 2023). This could drastically harm an efficient market mechanism, namely the issuance of climate certificates to manage and control CO2 emissions.

The current market

To get closer to net zero, many companies take compensation efforts by investing in CO2 projects or purchasing voluntary CO2 credits. Nestle, Bentley, Hilton, and SAP are only some companies that are South Pole customers (www.southpole.com). The quality of the underlying projects is assessed by a variety of players such as “Verra” (www.verra.org) or “Gold Standard” (www.goldstandard.com), which evaluate the eligibility of projects as well as their CO2 savings potential. To move the discussion from the anecdotal level to a more analytical approach, we have taken the first step by analyzing their project database.

Both agencies have evaluated 6,262 projects since March 17, 2009. These projects account for 2.1 bn annual carbon credits with an average project duration of 8.7 Years. Verra accounts for roughly 90% of the credits and 54% of the projects. The following three key questions about the whole set of projects are of particular interest.

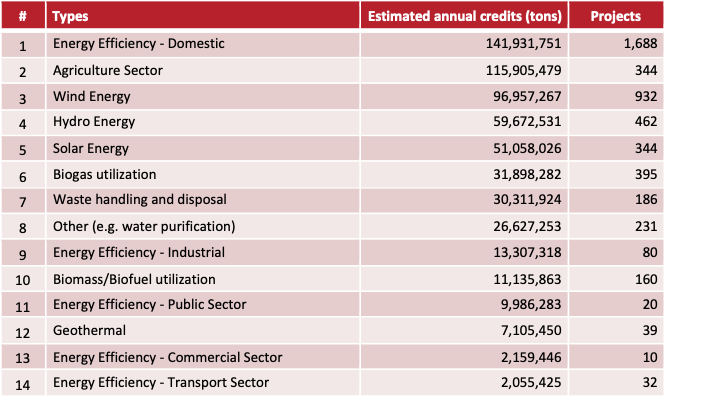

Question 1: What are the corresponding project types?

Figure 1 shows the projects of the Verra and Gold Standard database clustered by project types and ranked based on their estimated annual CO2 credits. The greatest number of projects and estimated annual credits are associated with projects aiming to change the way people are using energy in a domestic setting. Examples are the introduction of energy-efficient cooking stoves instead of cooking on an open fire or the replacement of inefficient generators. The next category is called the “Agricultural Sector” and includes various reforestation projects, conservation of existing forests, and projects aiming to make agriculture more efficient. The third category focuses on generating energy through wind power and comprises wind turbines.

It is important to note that only already registered and listed projects are included in Figure 1. Currently, more than 1,232 projects with an aggregated volume of more than 500 million CO2 creditsare under development, under validation, or already rejected by the two agencies. The following two figures only include registered or listed projects as well.

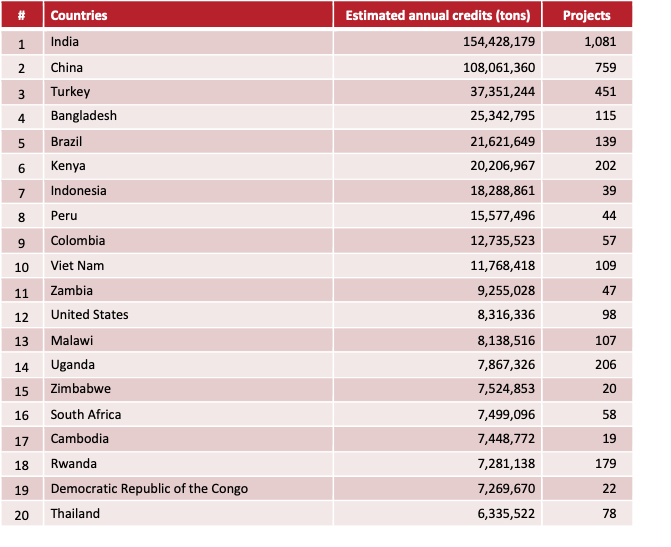

Question 2: Where are the projects located?

There is a strong concentration of projects in India, China, and Turkey, countries which are neither known for the highest level of quality, nor objective, non-political economic action. A second group of countries shares the same attribute which is a large amount of rainforest available. Especially in these countries, many projects focusing on reforestation and forest protection are located.

It is noteworthy that the USA ranks no. 12 in terms of estimated annual CO2 credits and Germany is ranked no. 27. The latter almost only has projects related to methane usage out of coal mines. Consequently, it would be interesting to understand where Germany`s massive renewable investments and energy efficiency projects are.

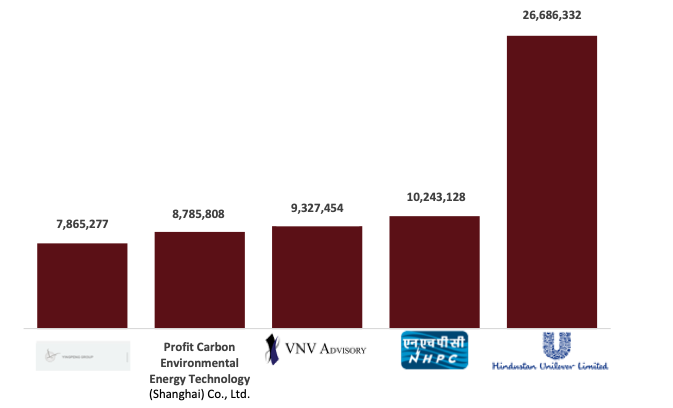

Question 3: Who are the project developers?

The largest project developer is Hindustan Unilever, an Indian consumer goods manufacturer with its headquarters located in Mumbai. Reaching net zero is the focus of this company which is why they are an active player in the project development of CO2 compensating projects. Second is NHPC Limited, the largest hydropower development organization in India. The third largest developer is Value Network Venture Advisory Services Pte. Ltd. a project finance/developer of climate-resilient and innovative projects. Project developers which are known in Europe such as CO2balance UK or South Pole Carbon Asset Management from Switzerland are ranking 6th and 12th in the list. However, most projects are led by a consortium of multiple partners (multiple proponents) which have been excluded since the participating developers vary from project to project.

How the UN will come in

The World Meteorological Organization (WMO), Geneva, is currently in the process to introduce a new harmonized methodology to measure and monitor CO2 as well as other gases in the atmosphere. They can be based on their success in harmonizing and standard setting in the world’s weather forecasts, and their corresponding models as well as initial pilot projects concerning climate data.

Their approach would allow for routine, near real-time monitoring which could enhance the ability for all market participants to drill down into key drivers of emissions, as well as establish a harmonized basis for a (re-)evaluation of carbon projects in developed as well as in developing countries. This again has the potential, to provide quality and transparency to the carbon certificate market and thereby make a carbon certificate an effective market instrument.

Perspective

In late May 2023, the WMO Congress, comprised of all member states, will decide upon the global mandate for this initiative. We believe it is not only a convincing approach but also a successful path out of litigation risk in carbon offsetting markets which will attract a lot of investments thereafter. We come up with the corresponding update in early June and look forward to an intensified discussion with all of you!

Next steps

The above insights raise a whole range of follow-up questions as well as a follow-up activity. Key aspects are:

- How is the new data infrastructure for the WMO program set up within the next 3-5 years?

- Which data analysis and forecasts are possible (in analogy to weather data)?

- How do future carbon project ratings look like?

- How do Europe and the US come in?

- How does a homogenous asset class “carbon credit” look like?

- How will the market – particularly also for voluntary carbon credits evolve?

- How can corporates as well as privates buy and sell carbon credits?

There are only two clear aspects: the carbon certificate is the right means to facilitate market mechanisms around net zero and this market will be huge with first movers being able to gain a substantial advantage.

Autor